Many nations that experimented with the Fed’s economic recovery plan are now going beyond the outer limits into the twilight zone of negative interest rates. Some of these nations continued to skirt in and out of the edfge of recession throughout their years of economic stimulus; so, now they’ve powered their programs into hyperdrive to see if they can escape the gravity of their circumstances. Their situation appears desperate and hopeless.

Reality in the alternate universe of zero interest rates and quantitative easing

Immediately after the Fed’s economic acceleration ended in the US, we’ve watched $3 trillion of paper wealth get sucked into a stock market collapse in less than one-and-half months, and that collapse appears to be accelerating to where the Fed is now talking about negative interest rates, too.

In spite of such talk, we are told the US cannot be in recession because recessions typically begin nine months after a bear market breaks out. That premise may be “typically” true, but what is typical about the present situation? Do things work the typical way when you are crashing back down into a recession you never really escaped? Perhaps the Great Recession was the black hole of all recessions. For all of our efforts, we have not escaped it and feel ourselves pulled right back into it now that we’ve exhausted our fuel on futile financial experiments.

Once nations moved into zero interest rates, we entered such a strange new realm of economics that no one in history has ever experienced this kind of an economy. As nations now move past that bound into negative interest rates, can we really know what is “typical” anymore? I think the word “typical” simply doesn’t apply in our present circumstances.

“Trying to divine the end of the rout is difficult given the globe is in the midst of a series of tightly intertwined, self- reinforcing, and correlated trades and narratives (i.e. oil slumps and drags inflation down with it which prompts central banks to ratchet up accommodation which sinks banks which crushes general market sentiment and the overall price declines tighten financial market conditions and scares corporate execs and actual economic activity begins to deteriorate),” conclude [JP Morgan] traders. (Bloomberg)

It seems that financial marketsSeven years of zero-interest targeting by central banks means we have entered an alternate universe where market dynamics are different to such a degree that economic nature is no longer what we are used to: True price discovery of the right cost for credit vanished long ago. True price discovery in the asset market ceased to exist because prices may rise to virtual infinity when trillions of dollars are practically free. Risk ceases to matter when money is practically free in any amount necessary to accelerate the economy . . . so long as you’re a preferred customer of the Federal Reserve (but not for anyone else).

In such a bizarre universe, recession may appear in multiples spaces at the same time once a central bank ends its artificial stimulus because all the distortions are so intertwined. Maybe the move to an inflated universe that happened from years of massive quantitative easing doesn’t unwind by just reversing from where we are back to our point of entry. Maybe this unusual universe unravels everywhere all at once so that recessions are not preceded by bear markets, but happen simultaneous to them. Maybe we see a bear stock market here and bear bond market there and a bear commodity market further over there—all markets that are moving into recession.

I believe all the frayed ends we see today are evidence of global unwinding from years of quantitative asset inflation. Zero interest is now completely ineffective, as I predicted it would become by fall of 2015 due to the law of diminishing returns—one of the realities we pretended we could live outside of. That law now demands we move into negative interest as the final flawed step of a rescue program so clearly unsustainable and so risky that it boggles the mind it was ever undertaken in the first place. What central planners are oblivious toward, however, is that negative interest is a black hole into an even more bizarre universe.

Experts often take risks beyond quantifying because they are experts

Will the US central bank follow others and zoom into the realm of negative interest rates, pretending they understand all the risks when they clearly did not even understand all the risks of zero-interest rates?

Let us look at the nature of human arrogance in the face of human ignorance. Humans are currently ramping up the accelerated ramming of nuclear particles in Cern, Switzerland, after the director of the program said there was “only a minuscule chance” they would create a black hole by accident. “Only a minuscule chance” of creating something that could devour the entire galaxy if created? That apparently is a risk worth taking, since it is so unlikely?

But these are scientists and should be trusted because scientists know stuff. Remember how nuclear scientists assured us there was no chance of a meltdown at Fukushima? I thought, as they said it, “A meltdown has probably already started. Nothing would withstand this many shocks.” Sure enough, Fukushima was already melting down, even as scientists on television assuaged our fears by telling us that meltdown was impossible due to failsafe human engineering.

Turns out science and engineering had not quite accounted for the combined and very minuscule chance of a 9.3 earthquake, several 8-point earthquakes, hundreds of 7-point earthquakes and thousands of 6-point and lower earthquakes, plus a tsunami of ice-cold salt water, followed by overheating due to cooling systems being knocked out, followed by major explosions that blew the roof off the containment buildings, followed in turn by dousing the red-hot reactors with days and days and tons of tons of additional ice-cold water.

I mean, what are the odds of all that happening? Zero, right? There is no way so many horrible and extreme variables could happen in the same place at nearly the same time, right? Well, turns out it did happen and that, good as the human engineering was, it was not up to the impossible odds of so many stresses happening one after the other and sometimes simultaneously. But the human plans were failsafe and had accounted for every realistic possibility. Turns out sometimes the unrealistic possibilities take over.

Likewise, there was also only a minuscule chance that scientists would create a more dangerous mosquito when genetically engineering a replacement to the mosquito that spreads dengue fever. Just to be extra cautious, they built in a genetic failsafe, which would only allow the genetically modified mosquito to continue to breed in the presence of the antibiotic tetracycline, which they could withhold from the mosquitoes environment once it had finished its job of breeding the bad mosquitoes out of existence.

Unfortunately, those scientists didn’t stop to realize that tetracycline exists out in the Brazilian countryside in significant amounts where the GM mosquito was being released because Brazil raises a lot of beef that poops out the antibiotics that the cattle are fed. That meant Brazil was literally littered with tetracycline. The great minds hadn’t thought of that. Now we have dengue fever appearing as an epidemic in Hawaii, and Zika virus spreading rapidly because it turns out the new genetically modified mosquito has a great propensity to spread Zika virus, which was a variable the scientists also hadn’t thought of, though the plan was failsafe due to the tetracycline key.

Based on this brief survey of the risk great minds will readily take based on their hubris, I don’t think it is a stretch to think the arrogant minds of the central bank’s mad wizards of of economic alchemy might have already created a disaster they cannot contain, and that there is fair likelihood they will accelerate right into the center of such a disaster if they hit the hyperdrive of negative interest rates. There is, after all, only a minuscule risk that negative interest rates will turn out to be the black hole of the financial universe.

Our central bankers and the publications that are now encouraging us to follow their lead tell us not to fear negative interest rates. They tell us we should not fear the ramifications of massive changes to thousands of years of financial evolution because the central banks have built in failsafe mechanisms. The odds of an unseen catastrophe—like a black hole that can eat up an entire galaxy over time—are minuscule. Besides that, our central bankers are smart—very, very smart—and they have the courage to lead, so we should have the courage to follow. Just ask them.

What might negative interest rates look like in the near future?

As I said in a recent comment on another article on this blog, we’ve completely moved away from the sound fundamentals of capitalism and into derivative capitalism—something that looks like capitalism because it was derived from capitalism but it smells of halibut genes spliced with tomatoes where we don’t even know anymore if we’re eating a plant or animal. (Yes, that is another one of the real wunderkind creations of the GMO crowd! Hallelujah!)

I don’t even know how one should categorized this capitalist-born, debt-laden, service-based, minimally-producing, semi-fascist, centrally controlled, bank-run, artificially monetized economy. I guess one would best call it “junk.” It’s junk economics. Our emerging brave-new-world economy is a jalopy of wired-together, custom, hot-rod and worn-out parts. “Trust us,” our pilots say, “This baby will fly straight through the outer bounds of the known universe and come out glorious on the other side.” Let us hope the caterpillar truly emerges as a butterfly because it looks like the journey is already being dialed in.

The central banks already started going negative in other parts of the world in an attempt to save us from their fake recoveries. In fact, they are already going more deeply negative because the dip into the negative-interest zone isn’t working. Still, “Trust us. Don’t audit us,” they say, “because we are good at what we are doing.”

. . . And, yet, those negative rates are already causing problems to where bankers and economists around the globe are crying loudly about the need for societies to become cashless quickly before the banks fail from the sided effects.

If negative interest fails by squeezing under-reserved banks, what will the attempted resolution to that problem look like? Will central bankers print cash to distribute directly to consumers in an attempt to inflate consumerism? Or will they confiscate cash in order to save their own member banks?

The central bankers are, of course, certain that they have already engineered plenty of safety buffer into the reserves of the banks; but that reminds me of the Fukushima engineers and scientists who felt they had engineered the reactors to withstand every stress that could reasonably be thrown at them, forgetting that sometimes the real world moves beyond reasonable expectations.

Will nations go cashless as major banks and globally famous economists are now calling for us to do? Will they offer 90% on the dollar or pound or euro for return of cash by a certain date, followed by 80% and then 70 and on down to zero in order to put an end to the cash already in circulation?

Will we crash into the proverty of the thirties or something even worse? If we see that coming, will those who are opposed to going cashless now change their words like a man facing torture in order to avoid the approaching pain? Will the cash crowd, say, “Go cashless and spare us the pain?” Even after nations go cashless, won’t the banks exact more money out of you 3% or 4% at at time . . . endlessly . . . just for holding on to your money from one month to the next once they have that power?

What have we observed of negative interest rates so far?

Banks want to see stocks rise, especially their own; the stock market want’s to see interest reduced again, but interest virtually has nowhere down to go but negative, and banks squeal with pain when punished with negative interest on their reserves. It’s a vicious circle where interest cannot go lower without hurting the banks. Can this new reality unwind without falling apart everywhere?

Negative Interest Rate Policy is the Hadron Collider of economics. It’s performing experiments that have never been tried before—at least, not at any kind of national level. But we already have a glimpse of what life looks like inside of that black hole. We can hear the screams of those who have already entered. The reports are already coming in.

It seems that financial markets increasingly view these experimental moves as desperate and consequently damaging to financial and economic stability. (PIMCO’s Scott Mather, ContraCorner)

And, yet, we want to go there.

When Japan hit its hyperdrive and punched into negative territory, it turned out taking interest down into the negative realm had a reverse effect. Instead of pushing stock markets up, as it had hoped, they plummeted after an initial brief rise. The market acted with revulsion when Japan went negative. Banks took the biggest hit, falling 28%.

Maybe having your atoms squeezed through the singularity of a black hole into the negative-interest universe makes one nauseous. Stocks didn’t go up; they threw up.

And, yet, we still want to go there.

The nearly instant revulsion didn’t prevent the governor of Japan’s central bank from saying he will go even deeper into negative territory if necessary. Yes, he will plunge his nation deeper into something that is making the problem worse in order to solve the problem. I guess this is how great minds think once they have entered the negative universe where everything is the opposite of the universe we are used to.

JP Mogan believes Japan can go as low as -3.5% without creating a run on the banks, although they fear a flight to cash in inevitable if negative interest is pursued too aggressively, but they recommend, all the same, that Japan push the edge of the envelope:

“It appears to us there is a lot of room for central banks to probe how low rates can go,” they said. “While there are substantial constraints on policymakers, we believe it would be a mistake to underestimate their capacity to act and innovate.” (Bloomberg)

Raising interest rates on the deposits of ordinary savers (called negative interest because the banks used to pay you, and now you’ll pay them) is something these banksters refer to as “innovation.” That is a true banister’s idea of creativity! New ways to suck money out of the little guy! They warn, however, that there is currently one limit on their innovation—the availability of cash as an escape pod from the negative-bound mothership.

The alternate nature of this new financial universe can be seen in the trajectory taken by the yen. Rather than going down further in value as happened when interest rates were going lower while Japan was still in the positive zone, it went up. That was an unexpected result.

Unexpected results imply unexpected risks, especially when things work in the exact opposite manner from what you expected. Delving rapidly into this unexplored territory, central-bank economists look like mad scientists, recklessly pursuing new discoveries on the blind belief that really bad things just cannot happen because they are smart enough that they’d see it coming.

All that is needed to summarize all of this is any one of several words or phrases: Fukushima, Chernobyl, Three-Mile Island, fracking quakes, Zika virus.

Nevertheless, that is where our central banks are determined to go now that zero-interest rates have clearly failed to deliver a sustainable recovery:

International Monetary Fund director Jose Vinals said this week that central banks will continue to push interest rates further below zero if policy makers decide that’s best for the economy. (ContraCorner)

Negative rates have helped global stocks enter a bear market, sent the cost of protection against corporate defaults soaring and driven investors to havens such as U.S. Treasury bonds and gold. “Central banks are getting out of control; They are now more a problem than a solution,” said Stephen Jen, co-founder of SLJ Macro Partners LLP in London and a former IMF economist. “Central banks keep trying newer things, but we increasingly see breakages in banks, in the markets.” (Bloomberg)

For my own part, I did not see and did not appreciate what the risks were with securitization, the credit ratings agencies, the shadow banking system, the S.I.V.’s. I didn’t see any of that coming until it happened. (Janet Yellen to the Financial Crisis Inquiry Commission, 2010 (27 minutes into the recording))

All that is needed to summarize all of this is any one of several words or phrases: Fukushima, Chernobyl, Three-Mile Island, fracking quakes, Zika virus.

Riksbank, Sweden’s central bank, got no benefit from exploring where no man has ever gone before—i.e., beyond the negative-interest bound—so it decided last week to double down, penetrating almost twice as deep into economic oblivion to see if going twice as negative would improve the results.

With Sweden’s subzero rate now at 0.50%, Riksbanks has said it will go even further subzero if necessary. Apparently, there is no end to the madness, even when it isn’t working. Sweden, however, believes it is working because it is bringing rates down on loans. (That doesn’t mean, however, that the availability of more debt at even lower interest is accomplishing anything useful for Sweden’s economy. Maybe it is just piling up more debt and more trouble for the future, or maybe no one wants the loans at any cost because we’ve reached maximum household debt.)

Riksbank’s governor indicated the central bank can go much deeper if it needs to—that it is “way, way, way, way too early to tell” if NIRP is hurting banks. He couldn’t seem to say enough “ways” in terms of how far we are from knowing if negative interest will backfire. At the present level, he said the possible damage to bank profitability from negative interest rate policy is not an issue. So, he’s apparently ready to push the hyperdrive a lot harder straight into the black hole to see if he can come out the other side.

The Gov also denied that Riksbank’s actions were a war on currency with the eurozone. Each bank, he indicated, is just doing what it needs to do to help its own economy. Whether Sweden is engaged in an intentional battle of the krona versus the euro or not, it seems pretty clear that the results are the same as a war on money.

Governor Ingves did say that inflationary differences between the Eurozone and Sweden are the impetus for dropping interest in Sweden. He said that inflation is low in other countries and “that causes an issue for us, and it would be even more of an issue if exchange rates started to appreciate rapidly. For these reasons we felt that it was time to act.”

I hear that and wonder, What’s the difference between that and a currency war? Sounds like a battle to the bottom to me.

According to one of the largest banks in Europe, Deutsche Bank, Germany’s entry into the black hole of negative interest rates is causing the bank stress at a time when it cannot sustain against that stress. This concern seems to have had the unintended and unexpected side effect of contributing to the crash seen last week in Deutsche Bank’s stock value. It certainly contributed to the bank begging the German government to go cashless if it’s going to go into the alternate negative universe so that DB can hand those negative rates down to its depositors without fear of the depositors taking their money and running.

DB and Credit Suisse joined banks in Italy and Greece in plumbing record lows in stock value last week. So, that’s what we know of the results of negative interest in Europe where such rates have been explored off and on for a couple of years. Yet, talk now is of the need to go deeper . . . like a meth addict needing more and more.

All of this risk is taken for two reasons: One is that central planners of the economies of this world believe you need to spend your money more quickly to drive the economy and that you will if you know you’ll lose your money by holding on to it. But for the present, there remains another way to get your money out of the bank without spending it. It’s called “cash withdrawal.” Thus, banks have been reluctant so far to pass the cost along and are hurting by absorbing the hit themselves.

Central banks are applying NIRP anyway because of the second reason: they are a little less concerned about getting you to spend your money (though they’d love to accomplish that, too) than they are about getting banks to stop hoarding money and move their reserve deposits.

While I have no sympathy for big banks that hoard wealth, I have to wonder about the likely successfulness of a strategy that puts the squeeze on banks at a time when their stocks are already under pressure due to crashing financial agreements in the oil industry.

Isn’t this the very time when you want banks to have high reserves in order to be able to cover their losses and to maintain their liquidity if a panic ensues among depositors who hear the bank is struggling under multiple bad loans of mammoth size? Is now the right time to push them to get rid of “excess reserves?”

Denmark, Switzerland, Sweden and Japan are all practicing negative interest rates now. Banks in Spain and Germany have dipped along the edge, regardless of where the European Central Bank stood. However, the ECB has veered the entire eurozone inside the edge of negative interest rates to no avail. As with Riksbank, the ECB had to double down on going negative (from -0.10% to -0.20%), still to no great benefit

Negative interest rates, whether imposed by individual banks on savers or central banks on their member banks, have not kept any of those nations from seeing their economies get worse.

Negative rates have started having less beneficial effects on Germany’s savings banks. While lower rates have been successful in pushing down the cost of borrowing, they have been far less successful in reducing the cost of funding to financial institutions. That is, the interest that these banks can charge on loans they are giving to businesses has been falling much faster than the interest rates they are having to pay for money provided by depositors. (Business Insider)

In spite of the failure of negative interest rate policy everywhere it has been tried, Israel is also about to explore the nether regions of interest, according to Citigroup strategists, who also forecast that Czech Republic, Norway and Canada could follow suit.

Apparently there is no end to this madness because Chairwoman Yellen jumped on the bandwagon last week and said that the Fed can hardly avoid considering negative interest rates now that everyone else is doing it. Therefore, the Federal Reserve is also exploring negative interest rates by stress-testing banks to see how they will perform if such rates are applied.

Yellen also noted that the Fed will be carefully checking the legality of imposing negative interest rates on savers, but she doesn’t see anything that would stand in the Fed’s way of syphoning off your money (my way of wording it, not hers). So, it looks like we’re all-in on the negative-interest-rate bandwagon. Get into your suspended-animation cocoon. We’re about to go hyperdrive through the black hole of finance . . . just because we can, not because it has been seen to work anywhere in this universe.

Something wicked this way comes

All of these banks agree on one thing—that the ultimate barrier to the potency of negative interest rates is the presence of cash as an alternative. Cash is not completely the barrier many thought because savers, as the experiments around the world have revealed, would rather pay some interest to the banks on their deposits than switch to the inconvenience of cash. People, for example, don’t feel safe sending cash in the mail to pay their bills. They don’t feel safe hoarding it under a mattress, but they are inclined to move more and more of their deposits into cash as the bank charges interest on their deposits.

Nevertheless, the push to go cashless is getting so intense that I have to wonder if the negative-interest-rate drive is not just a pretext for going cashless. (In other words, maybe going cashless is the real goal is going cashless and negative interest as our salvation from the Great Recession that we obviously still have not escaped is just a narrative to support going cashless. I only wonder because negtive interest has proven to be ineffectual so far. So, why is it being pushed at all?)

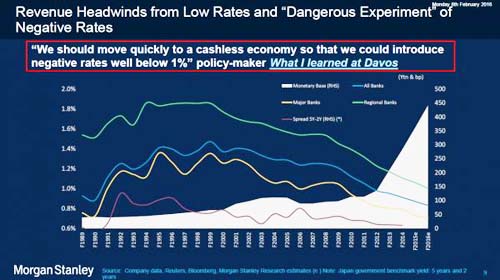

And while in recent days we have seen op-eds by both Bloomberg and FT urging the banning of cash, the most disturbing development we have seen yet in the push for a cashless society has come from the following slide in a Morgan Stanley presentation, one in which the bank’s head . . . pointed out the following . . . (Zero Hedge)

Note the bank president’s urgent note on the graph:

I sat next to someone in policy circles who argued that we should move quickly to a cashless economy so that we could introduce negative rates well below 1%—as they were concerned that Larry Summers’ secular stagnation was indeed playing out and we would be stuck with negative rates for a decade in Europe. They felt below (1.5)% depositors would start to hoard notes. (Zero Hedge)

Over seven trillion dollars worth of bonds now trade with negative nominal interest rates, meaning the person buying the bond knows they will be losing money but prefers the risk of a known small loss to other risks or that the person needs the bond for reasons that make it worth taking that loss, such as to collateralize his margin stock purchases.

Even in a cash-available environment, a vast amount of debt is being purchased at negative interest. The only reason for wanting all nations to become cashless societies is to make sure banks can go even deeper into charging you money for letting them hold your money—to remove the ultimate escape hatch. Their sole solution to saving the economy now is to stick it to you. Or is saving the economy just an excuse to get to sticking it to you?

If this sounds insane, so did quantitative easing less than one decade ago. Governments want much deeper negative interest rates in order to be able to continue to service their massive debts—because negative interest rate policy (NIRP) turns those debts into profit centers, rather than losses. It’s not hard to find ulterior motives for going negative that have nothing to do with the ability of negative rates to save the economy. Maybe they have now become necessary to save governments from their debt.

Over the last few months a stream of articles have crossed my screen, all proclaiming the need of governments and banks to eliminate cash. I’m sure you’ve noticed them too. It is terrorists and other assorted madmen, we are told, who use cash. And so, to protect us from being blown up and dismembered on our very own street corners, governments will have to ban it. It would actually take some effort to imagine a more obvious, naked attempt at fearmongering. Cash—in daily use for centuries if not millennia—is now, suddenly, the agent of spring-loaded, instant death? And we’re supposed to just accept that line? (ContraCorner)

They are counting on your accepting the new course they want to lay in and are broadly building the case now.

We witnessed how much freedom and human rights citizens in the US were willing to give up when fear from 9/11 gripped the nation. “Record all our phone calls and emails for later extraction if needed? Sure.” “Tap our phones without a court warrant or enter our homes for search and seizure without a court warrant, so long as you brand us as terrorists? Absolutely.” “Store every stroke of our keyboards in case someday we become criminals and note every Google search? Of course.” “Create an entire bigger, more complex branch of government when you’re the party of small government by calling it ‘Homeland Security?’ Don’t even hesitate.”

So, the same fears are now being played everywhere against cash. Cash is considered the new shadow banking system—the refuge of thieves and thugs—the foundational support of terrorist organizations. If we get rid of it, we’ll be able to keep an eye on what those guys are doing because they will lose their ability to operate anonymously.

The same weak-willed, modern Americans who now glibly give up free speech in order to make sure speech doesn’t insult anyone will give up cash, too. Cash is, after all, germ-infested and inconvenient compared to bumping your phone on some company’s register. (It won’t be long and the concept of a “cash register” will be as antiquated as a telephone on a wall. “A land line?”)

Though cash has been king in national economies for millennia, cash is being kicked out the back door as a backward and homely relative, not fit for modern company. In spite of all the fear tactics, the real reason for eliminating cash is to allow banks to profit off every transaction you make and every credit you hold too long and to give central banks absolute control over the monetary system, which equates to broad control of the national economy. Aren’t bankers the ones you would want to entrust with that?

Governments, too, will gain total economic control and possibly additional surveillance unless the new cashless system is anonymous, but who will know if any new cashless system truly is anonymous? How many people knew that so much software had designed backdoors for government spying?

Government could even decide to limit your ability to purchase anything but the essentials of life in order to penalize you for whatever they deem wrong. There are many ways in which going cashless gives governments and their henchmen at the central banks total control over economies and over the life of citizens. This, of course, is all the death of capitalism. I’m not sure what to call the economic system that emerges, other than some form of neo-fascism. Or maybe George Bush’s “voodoo economics.” Or just stay with “junk economics.”

Bankers, after all, are the ones who know how things work and who are smart enough to save us . . . by making sure we take on additional debt or spend our money to save the economy from the bad policies of government that burdened the economy beyond repair. Cyprus a couple of years ago was but a test of what it takes to wrench cash out of the hands of citizens and to test whether they will rebel with pitch forks or acquiesce with nothing more than gloom.

It appears, that without regard to risks unknown, we are all headed beyond the zero bound in a ship called the “cashless economy.”

Fukushima, Chernobyl, Three-Mile Island, fracking quakes, Zika virus.

David Haggith is a widely published writer and he also publishes The Great Recession Blog, where this originally appeared.